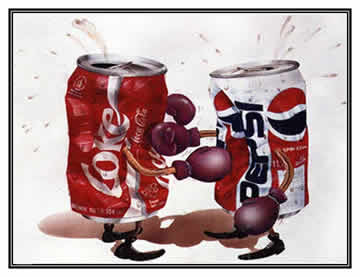

Your favorite taste or your favorite brand

Subscribe to Decision Science News by Email (one email per week, easy unsubscribe)

Subscribe to Decision Science News by Email (one email per week, easy unsubscribe)

NEURAL CORRELATES OF BEHAVIORAL PREFERENCE FOR CULTURALLY FAMILIAR DRINKS

Are preferences for culturally familiar drinks such as Coke or Pepsi based solely on the taste or are there other factors involved? A recent article in Neuron discusses how cultural messages may be more influential than taste in the development of such preferences.

ABSTRACT

“Coca-Cola_ (Coke_) and Pepsi_ are nearly identical in chemical composition, yet humans routinely display strong subjective preferences for one or the other. This simple observation raises the important question of how cultural messages combine with content to shape our perceptions; even to the point of modifying behavioral preferences for a primary reward like a sugared drink. We delivered Coke and Pepsi to human subjects in behavioral taste tests and also in passive experiments carried out during functional magnetic resonance imaging (fMRI). Two conditions were examined: (1) anonymous delivery of Coke and Pepsi and (2) brand-cued delivery of Coke and Pepsi. For the anonymous task, we report a consistent neural response in the ventromedial prefrontal cortex that correlated with subjectsâ behavioral preferences for these beverages. In the brand-cued experiment, brand knowledge for one of the drinks had a dramatic influence on expressed behavioral preferences and on the measured brain responses.”

QUOTES

“Cultural influences on our behavioral preferences for food and drink are now intertwined with the biological expediency that shaped the early version of the underlying preference mechanisms. In many cases, cultural influences dominate what we eat and drink. Behavioral evidence suggests that cultural messages can insinuate them-selves into the decision-making processes that yield preferences for one consumable or another. Consequently, the appeal or repulsion of culturally relevant sights, sounds, and their associated memories all contribute to the modern construction of food and drink preferences.”

“These two stimuli [Coke and Pepsi,] were chosen for three reasons. (1) They are culturally familiar to subjects. (2) They are both primarily composed of brown, carbonated sugar water, and sugar water serves as a primary reward in many animal and human experiments. (3) Despite their similarities, they generate a large subjective preference difference across human subjects, which might correlate with fMRI-measured brain responses. We pursued three primary questions using the experiments presented in this paper. (1) What is the behavioral and neural response to these drinks when presented anonymously? (2) What is the behavioral and neural influence of knowledge about which drink is being consumed? (3) In questions1 and 2, is there a correlation between the expressed behavioral preference and the neural response as measured using fMRI?”

“The medical importance of understanding these questions is straightforwardâthere is literally a growing crisis in obesity, type II diabetes, and all their sequelae that result directly from or are exacerbated by over consumption of calories (for recent work see Chacko et al., 2003; Ford et al., 2003; Wyatt, 2003; Zimmet, 2003; Popkin and Nielsen, 2003). It is now strongly suspected that one major culprit is sugared colas (Popkin and Nielsen, 2003).”

“Most real-world settings present numerous primary sensations and top-down influences that act to organize a coherent behavioral preference. Studies have indeed shown that cultural information can modulate reward-related brain response (Erk et al., 2002). 2002). This general observation is particularly true for Coke and Pepsi; that is, there are visual images and marketing messages that have insinuated themselves into the nervous systems of humans that consume the drinks. It is possible that these cultural messages perturb taste perception.”

ABOUT THE FIRST AUTHOR

Samuel M. McClure

Samuel M. McClure is a psychology postdoctoral fellow at Princeton University. He received his PhD in neuroscience in 2003 from Baylor College of Medicine in Houston, Texas. “Broadly, my research lies in the area of reward processing. I am interested in how we respond to motivationally salient events, learn to predict them, and translate this knowledge into decisions to act. My work has focused on appetitive salient events, or rewards, and how they drive changes in neural activity in the basal ganglia and midbrain dopamine systems. These systems have long been associated with reward processing in the brain, but recently a new hypothesis has emerged which relates activity in these systems to artificial intelligence learning algorithms. The theory states that the dopamine systems calculate error in the prediction of reward that is then propagated as learning signals to the basal ganglia. Further, the basal ganglia are believed to use these signals to improve our decision making in the future.” âfrom Samuel M. McClureâs homepage

Jian Li

Jian Li is a PhD candidate at Baylor College of Medicine in Houston, Texas. He received his B.S. from Nanjing University in Nanjing, China. â from Jian Li’s curriculum vitae

Damon Tomlin

Damon Tomlin is a graduate student in the neuroscience department at Baylor College of Medicine in Houston, Texas. He received his bachelor’s degree in biomedical engineering in 2001 from Vanderbilt University in Nashville, Tennessee. âfrom the Baylor College of Medicine researcher profile

Kim S. Cypert & Latane M. Montague

Kim S. Cypert & Latane M. Montague are two people we can find little about, but we do know that Latane is Read’s daughter.

Read Montague

Dr. Read Montague is a Professor in the Division of Neuroscience at Baylor College of Medicine, Director of the Human Neuroimaging Lab, and Director of the Center for Theoretical Neuroscience. His work focuses on computational neuroscience – the connection between the physical mechanisms present in real neural tissue and the computational functions that these mechanisms embody. -from the Baylor College of Medicine Human Neuroimaging Lab